CEO at Dyson Laboratories

Calvin England is the CEO and co-founder of Dyson Laboratories, a company pioneering space-based Bitcoin mining. A United States Marine Corps infantry combat veteran, he earned a degree in Mechanical Engineering from Purdue University. Calvin has extensive experience in aerospace and aviation, having held positions at Blue Origin, Beyond Gravity, Northrop Grumman, and Extant Aerospace. His expertise spans circuit card and structures assembly, chemical etching, vacuum furnace heat treatment, and fluids testing.

What’s the origin story behind Dyson Labs — what first sparked the idea to mine Bitcoin in space?

The inspiration came from US Space Force Major Jason Lowery’s MIT thesis, Softwar, which reframed Bitcoin as a global power-projection tool; turning energy into digital sovereignty. That sparked the question: if satellites constantly generate surplus power, why not turn that excess into value with Bitcoin mining in space? Dyson Labs exists to unlock that trapped energy for new economic activity.

You’re tapping into a pretty futuristic concept — what’s the big-picture vision for Dyson over the next 5–10 years?

In five to ten years, our goal is for Dyson Labs to be the backbone of space-based distributed compute. We’re starting with Bitcoin because it’s simple, robust, and immediately monetizable. But our tech unlocks a future where satellites become not just power producers, but intelligent compute nodes; powering everything from AI inference to real-time communications. Our smart solar panels will make every watt in orbit earn revenue.

What excites you most about the space energy market right now, and why is now the right time to build this?

Right now, there’s a huge gap between what space solar power costs and what its raw materials cost (what is called the ‘idiot index’). It’s 2000:1 in space versus just 3:1 on Earth. That’s unsustainable. With SpaceX and Project Kuiper adopting terrestrial solar for use in space, the cost curve is finally bending. Dyson Labs can help drive these prices down by monetizing wasted energy. We can do it right now, not in the distant future.

You mention satellite operators can cut power costs by ~20% using Bitcoin mining — how does that work in practice?

Satellites often overbuild power capacity but only use 20% for their core mission; the rest is wasted. By mining Bitcoin with excess power, operators turn a sunk cost into a revenue stream, effectively subsidizing power costs by 20% or more, depending on orbit and connectivity. It’s about monetizing what would otherwise be dumped as useless heat.

How do you see Dyson generating revenue in the short term — and what’s the path to long-term scalability?

In the short term, we’ll generate revenue by deploying our mining hardware on partner satellites, prove the economics, then scale rapidly. Long-term, we’ll expand our tech to support other high-value workloads, like AI inference, and license our platform to satellite builders worldwide.

Are there other commercial use cases beyond Bitcoin that you’re exploring for excess space power?

Absolutely. Bitcoin is just the start; it sets a price floor for excess energy in space. But the real opportunity is in powering distributed AI, secure communications, and edge computing as bandwidth and connectivity improve.

You’re raising $1.5M at a $10M valuation — how will you deploy that capital to hit your next major milestones?

This raise funds our first flight to space, where we’ll prove our mining ASICs work in orbit and gather the data customers demand. Flight heritage is key; once we have it, we can move to full-scale commercial deployment.

What traction or early signals are you seeing — whether from customers, partners, or technical development?

We’re seeing strong interest from both component manufacturers and satellite integrators, eager to monetize their excess power. Partners like Auradine see this as a transformative use for their chips. The appetite for cheaper, more productive satellites is clear.

What kind of investors are you looking for — and how do you see them supporting the company beyond just capital?

We’re looking for long-term partners who believe in building new space infrastructure. Investors who can open doors, provide industry insight, and stick with us as we scale. If you want a quick flip, look elsewhere; if you want to help shape the future, let’s talk.

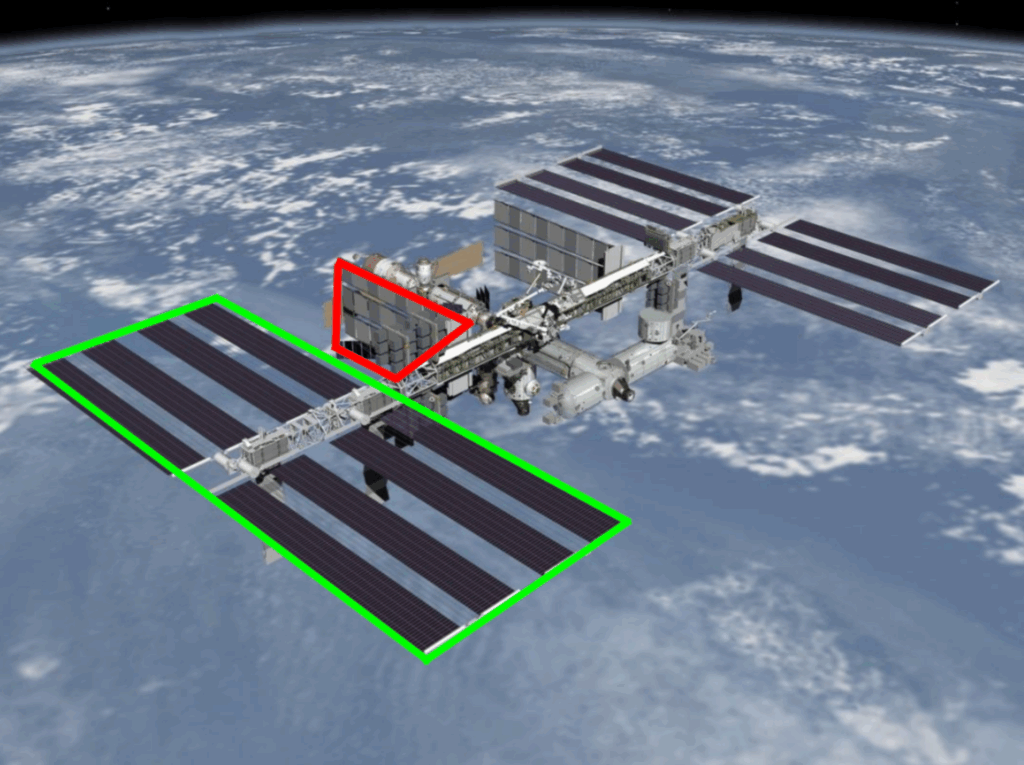

Can you walk us through the tech stack — what makes your solar panels, radiators, and ASIC integration unique?

Our system uniquely integrates solar, heat management, and mining ASICs into a single, space-optimized module. By directly converting surplus solar into compute and carefully managing the thermal load, we achieve higher efficiency than anything in orbit today.

How are you managing the engineering risks — especially when it comes to heat dissipation and radiation resilience in space?

We’re de-risking through rapid prototyping and in-house testing— including a custom-built thermal vacuum chamber. This lets us validate designs under space-like conditions and iterate fast, so customers can trust our system will work first time in orbit.

You mentioned your in-house thermal vacuum chamber — how does that accelerate product development or de-risk testing?

Owning our own TVAC slashes costs and accelerates learning 20-fold for both metrics. We can replicate extreme space environments, validate our system faster, and pass those savings and reliability on to customers.

How big is the market for space-based power, and where do you see Dyson Labs fitting into the ecosystem?

There’s over 100 MW of underused power in space today, growing to 250 MW by 2030. That’s a multi-billion-dollar opportunity that no one else has signed up to realistically tackle today. Dyson Labs turns wasted energy into revenue, starting with Bitcoin mining, but ultimately enabling a new layer of economic activity in orbit.

Are you already in talks with satellite operators or solar panel manufacturers — and what kind of partnerships are you pursuing?

We’re already engaging with leading manufacturers and integrators, with more deals contingent on successful flight demos. If you’re a component maker, operator, or integrator interested in monetizing your surplus power, we’d love to talk.

If things go as planned, what’s the ideal headline about Dyson Labs in 3 years?

Dyson Labs technology powers the majority of new satellites, turning surplus energy into revenue; Bitcoin mining is now standard in orbit, and we’re pioneering the next wave of distributed space compute.

You can find more interviews and articles on the UAE space ecosystem in our latest magazine.