The United Arab Emirates (UAE) has been making significant strides in the satellite industry in recent years. The country has invested heavily in space technology and infrastructure, and this has resulted in several satellite launches and successful missions. In this article, we will discuss the satellite industry in the UAE, including its growth, challenges, and future prospects.

Overview of the UAE Satellite Industry

The UAE’s satellite industry is relatively new, but it has been growing rapidly in recent years. The country’s space program started in 2006, with the establishment of the UAE Space Agency, which is responsible for developing the country’s space policies and overseeing its space activities. Since then, the UAE has launched several satellites and established partnerships with other countries and international organizations.

One of the UAE’s most significant achievements in the satellite industry was the launch of the UAE’s first satellite, DubaiSat-1, in 2009. This was followed by DubaiSat-2 in 2013, which was designed and built entirely in the UAE. The country also launched its first communications satellite, Yahsat-1A, in 2011, which provides voice, data, and video services to customers in the Middle East, Africa, and Europe.

The UAE has also established partnerships with other countries to further its space ambitions. In 2018, the country launched the KhalifaSat, which was designed and built in the UAE with the help of South Korean engineers. In 2020, the country signed an agreement with the US to cooperate on space exploration and the peaceful use of outer space. This partnership could lead to more joint projects and collaborations between the two countries.The country also partnered with Japan to launch the Hope Probe, which successfully entered Mars’ orbit in February 2021, making the UAE the fifth country in the world to reach the Red Planet.

Challenges Facing the UAE Satellite Industry

While the UAE’s satellite industry has been growing rapidly, it faces several challenges that need to be addressed to ensure its long-term success. One of the most significant challenges is the lack of skilled workers in the industry. While the country has made significant investments in space education and training, there is still a shortage of skilled workers who can design and build satellites.

Another challenge is the high cost of satellite development and launches. Developing a satellite from scratch can be an expensive and time-consuming process, and the UAE may not have the resources to finance multiple satellite projects simultaneously. Additionally, the country relies on foreign launch providers to send its satellites into space, which can be costly.

Future Prospects for the UAE Satellite Industry

Despite the challenges facing the UAE’s satellite industry, there are several opportunities for growth and development in the future. One of the most significant opportunities is the increasing demand for satellite services, particularly in the Middle East and North Africa (MENA) region. The UAE’s strategic location and growing economy make it an attractive market for satellite companies looking to expand their services.

Another opportunity for growth in the UAE’s satellite industry is the development of small satellites. These satellites are smaller and lighter than traditional satellites, which makes them more affordable and easier to launch. Small satellites can also be used for a variety of purposes, such as earth observation, telecommunications, and scientific research.

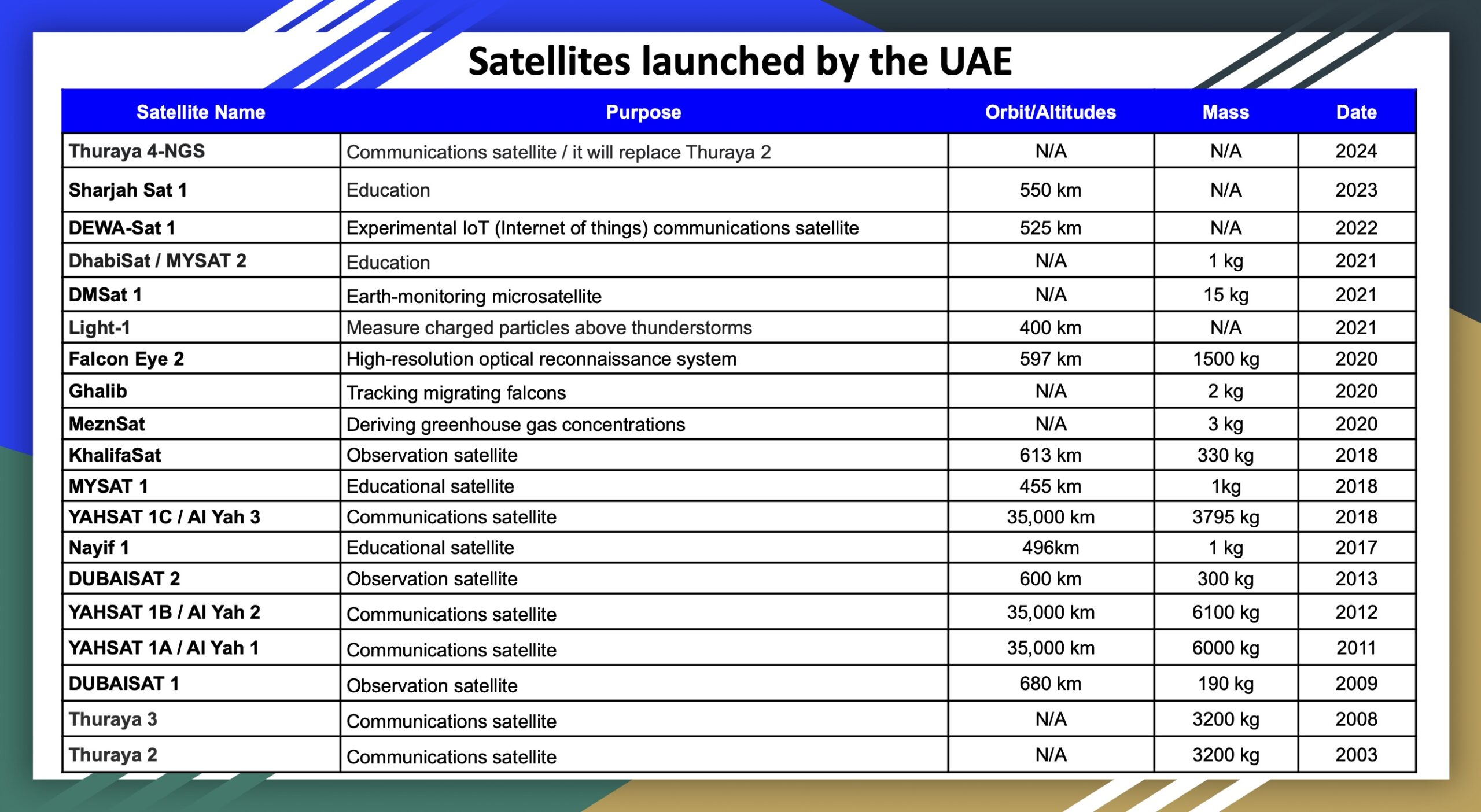

| Satellite Name | Purpose | Orbit/Altitudes | Mass | Date | Institution |

| Thuraya 4-NGS | Communications satellite / it will replace Thuraya 2 | N/A | N/A | 2024 | Yahsat Space Lab |

| Sharjah Sat 1 | Education The goal is to measure X-Rays from space and take pictures of Earth with at least 100 meter/pixel GSD. | 550 km | N/A | 2023 | University of Sharjah (SAASST). |

| DEWA-Sat 1 | Experimental IoT (Internet of things) Communications satellite | 525 km | N/A | 2022 | Dubai Electricity and Water Authority (Dewa) |

| DhabiSat / MYSAT 2 | Education | N/A | 1 kg | 2021 | Yahsat Space Lab and Khalifa University |

| DMSat 1 | Earth-monitoring microsatellite | N/A | 15 kg | 2021 | Space Flight Laboratory (SFL) for the Mohammed Bin Rashid Space Centre (MBRSC) in Dubai |

| Light-1 | Emirati-Bahraini measure charged particles above thunderstorms | 400 km | N/A | 2021 | UAE SA, Khalifa University, NYUAD |

| Falcon Eye 2 | High-resolution optical reconnaissance system | 597 km | 1500 kg | 2020 | Airbus Defence and Space and Thales Alenia Space for the UAE’s armed forces |

| Ghalib | Tracking migrating falcons | N/A | 2 kg | 2020 | Marshall Intech |

| MeznSat | Deriving greenhouse gas concentrations | N/A | 3 kg | 2020 | UAE Space Agency and in partnership with Masdar Institute/KU and the American University of Ras Al Khaimah (AURAK) |

| KhalifaSat | Observation satellite | 613 km | 330 kg | 2018 | Mohammed bin Rashid Space Centre |

| MYSAT 1 | Educational satellite | 455 km | 1kg | 2018 | Khalifa University Space Technology And Innovation Center |

| YAHSAT 1C / Al Yah 3 | Communications satellite | 35,000 km | 3795 kg | 2018 | Al Yah Satellite Communications Company |

| Nayif 1 | Educational satellite | 496km | 1 kg | 2017 | EIAST and American University of Sharjah (AUS) |

| DUBAISAT 2 | Observation satellite | 600 km | 300 kg | 2013 | Emirates Institution for Advanced Science and Technology |

| YAHSAT 1B / Al Yah 2 | Communications satellite | 35,000 km | 6100 kg | 2012 | Al Yah Satellite Communications Company |

| YAHSAT 1A / Al Yah 1 | Communications satellite | 35,000 km | 6000 kg | 2011 | Al Yah Satellite Communications Company |

| DUBAISAT 1 | Observation satellite | 680 km | 190 kg | 2009 | Emirates Institution for Advanced Science and Technology |

| Thuraya 3 | Communications satellite | N/A | 3200 kg | 2008 | Yahsat Space Lab |

| Thuraya 2 | Communications satellite | N/A | 3200 kg | 2003 | Yahsat Space Lab |

The overview of the satellite industry in the KSA can be found here.